Basics of business cycle – analyze in which stage now we are standing on

What is business cycle?

The dichotomy between linear and cyclic development has been created fresh and longstanding debates over the periods. The life cycle is a general concept that refers to the intended way of organic development. It reveals that all things and phenomenon has its own definite stages of development and these developments have a recurring nature. The business cycle describes the rise and fall in production output of materials and services in an economy. Normally, the business cycle is measured using the ups and downs in the real gross domestic product (GDP) or the GDP adjusted for inflation.

There is a difference between market cycle and the business cycle. The market cycle is measured using a broad stock market indices. The business cycle is also different from the debt cycle because debt cycle is measured using the rise and fall in household and government debt. The business cycle is also known as the economic cycle or trade cycle. The economic cycle is an umbrella concept that includes all the economic activities such as GDP, government debt, household debt, per capita income, government revenue, employment, market cycle, purchasing capacity, business slowdown, demand, supply, economic recession and all the economic parameters.

Understanding business cycles

Business cycles are variations in economic activity that an economy experiences over a period of time. These variations include output from all sectors including governments, households, markets, nonprofits as well as business output. So, the output cycle will give a better description of what is measured. The business cycles are usually measured by taking the real growth rate of GDP (gross domestic product) into consideration.

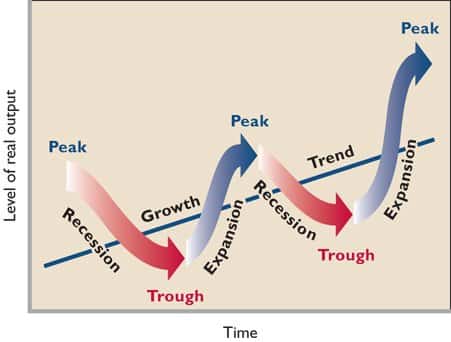

Contraction and expansion are the two phases of the business cycle. During expansion and economy experiences growth, while contraction is the period of economic recession or decline. During expansion, there will be a rise in employment, consumer confidence, and equity markets. It is the period of economic recovery. When we look into interest rates and capital expenditures, we can analyze to determine where we standing in the business cycle.

When business cycle peaks, the next phase is contraction. According to most economists, when a country’s real gross domestic product (GDP)—the most-watched indicator of economic contraction—has declined for two or more consecutive quarters, and then a contraction has followed. As the economy plunges into a contraction, unemployment increases, and the credit recovery of banks becomes harder.

After World War II, expansions were mostly linked with population growth, urban mass, and the introduction of consumerism. By the 1970s, growth came more from debt injections through consumer credit cards, commercial, mortgages, and industrial loans—as opposed to equity funding—followed by the dot-com speculation and then more hypothecation debt.

In contraction periods, people are failed to pay their mortgages because of the employment losses. The excess credit availability is a manmade phenomenon, so the contraction as well. But as a theory, business cycle won’t agree with this statement because it says contraction and expansion is the organic development of a cycle. That is where there is expansion there would be a contraction.

Stages of business cycle

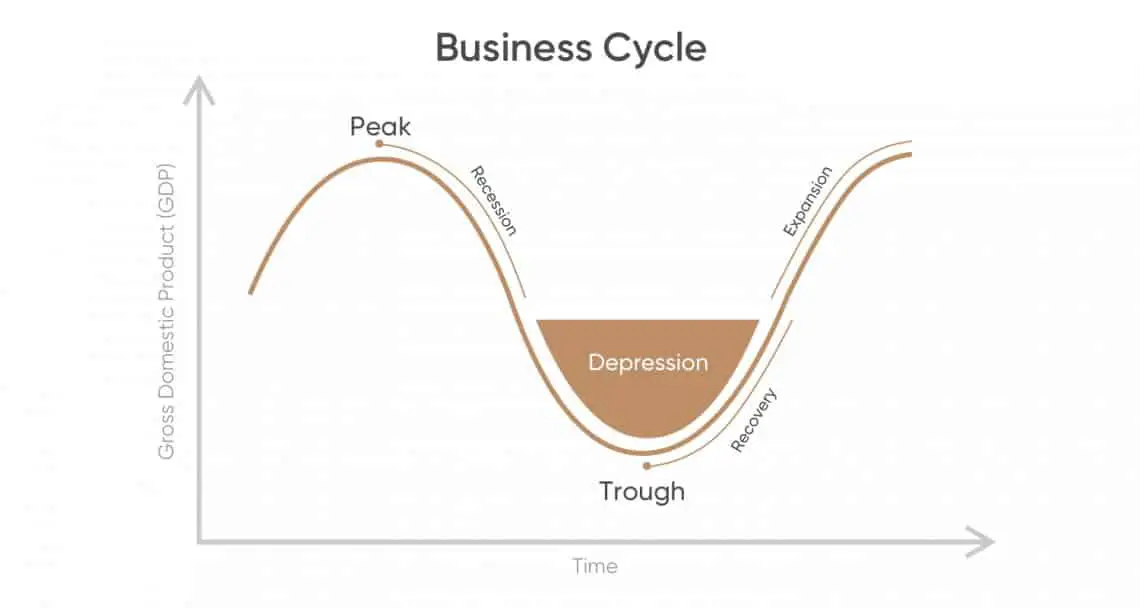

All business cycles are featured by a number of different stages, as seen below.

All business cycles are featured by a number of different stages, as seen below.

1. Expansion

This is the first stage. When expansion occurs, there is an increase in employment, incomes, production, and sales. People usually pay their debts on time. The economy has a stable flow in the money supply and in new investments.

2. Peak

The second stage is a peak when the economy hits a hurdle, having reached the maximum level of growth. This is the period of saturation. As per the cyclic theories, every growth phases has its own melting points, when it touches the peak, the decline begins. The stage can call as optimum point of growth. You can’t move beyond that. Prices hit their highest level, and economic indicators stop rising. Many people start to restructure as the economy’s growth starts to reverse.

3. Contraction

These are the period of recession. During contraction, unemployment rises, production slows down, sales start to fall because of a decline in demand, and incomes become stagnant or decline.

4. Depression

Economic development continues to fall while unemployment rises and production drops. Consumers and businesses experience difficulties to secure credit, trade is reduced, and bankruptcies start to increase. Consumer confidence and investment levels also decline. The people they have money will reluctant to invest their funds in the market, the results are the stock market will be plunged, and the FDIs to return from that particular market.

5. Trough

This period indicates the end of the depression, directing an economy into the next step: recovery. This is the period of bottoming. A bottom, before a rise. In this stage, the economic growth rate becomes negative. In addition, in the trough phase, there is a rapid decline in national income and expenditure.

6. Recovery

In this phase, the economy starts to turn around. Low prices spur an increase in demand, employment and production start to upsurge, and mortgagees start to open up their credit reserves. This stage indicates the end of one business cycle.

Note: Fiscal and monetary policy, demographic transition, technology, and external affairs like oil price hikes have affected the business cycle.

Some financial experts believe that the business cycle is the nature of the economy. It occurs as a natural cycle. But on the contrary, others believe that nations’ central banks indirectly control the cycle by intervening with monetary policy. For example, they believe that when the economy facing serious inflation, by interest hikes it can be regulated.

The business cycle is the repetition of phases over a period of time. The length of the business cycle is not generally of the same length and varies between 2 to 12 years. However, some of the business cycle has been short-lived, that is lasted 6 months or 2 to 3 years.

If you want to present the concepts of the business cycle, you can download suitable PowerPoint templates from slide bazaar gallery. Normally, circle diagrams are fit for business cycle presentation because of the self-explanatory theme.